**해외 스포츠 중계를 편하게 시청하는 최고의 방법** 스포츠 팬이라면 누구나 한 번쯤은 해외에서 펼쳐지는...

Blog

There is only one type of high-roller player in the exciting world of online...

신뢰할 수 없는 베팅 사이트에서 시간과 돈을 낭비하는 데 싫증이 났습니까? 더 이상 보지...

빠르게 진행되는 온라인 베팅 세계에서 베팅을 안전하고 보호하는 것이 그 어느 때보다 중요합니다. 사기와...

환영합니다, 온라인 베팅 애호가 여러분! 안전한 온라인 베팅의 세계를 통해 짜릿한 여행을 시작할 준비가...

Somehow, the Oscar VIP Direct Slot has become very popular very quickly. This has...

Å velge riktig boliglån kan by på betydelige utfordringer for potensielle boligeiere. Med et...

**스마트 도박꾼을 위한 궁극의 가이드에 오신 것을 환영합니다!** 빠르게 변화하는 오늘날의 디지털 세계에서 스포츠...

**제목: 온라인 도박 분야 최고의 사기 방지 기업** 카드를 한 번 돌리거나 뒤집기만 하면...

In the travel industry, sustainability increasingly takes the stage as awareness of environmental issues...

**제목: 온라인 카지노 사기 방지: 확인 안내** 회전하는 릴과 셔플 카드의 흥분이 인터넷 구석구석에서...

Å sammenligne lånetilbud fra flere banker er avgjørende for låntakere som søker den beste...

온라인 베팅 사기의 희생양이 되는 데 지치셨나요? 더 이상 보지 마! 이 블로그 게시물에서는...

It is possible for companies and investors to meet and work together on business...

Pet owners are traveling with their pets more and more often. More and more...

It can be difficult to start a new business, especially when you need to...

How can companies stand out in today’s tough job market to get and keep...

In order to keep the balance of fluids in our bodies, electrolytes are essential....

Hair transplants in Turkey that are not too expensive are becoming more and more...

A sensible and useful way to keep food fresh all day is to use...

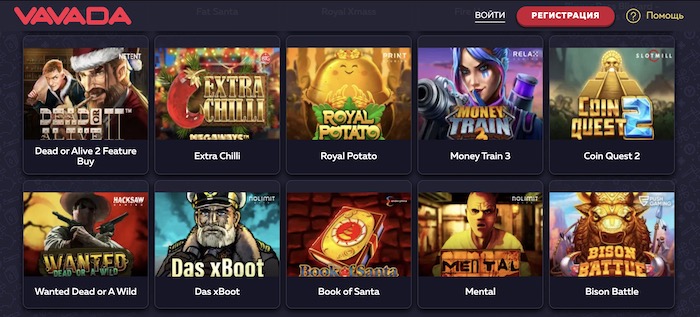

В мире азартных развлечений столкнулись два великих формата: традиционные казино и их онлайн аналоги,...

In the Philippines, online casinos have become very famous in the past few years....

온라인 스포츠 베팅의 신나는 세계로 뛰어들 준비가 되었나요? 빠르게 성장하는 이 산업의 고저를 헤쳐나갈...

The world of payments is always changing as new tools and ideas come out...

Want to find the best blogs about sports and fitness that will help you...

Do you want to get the most out of your MPO700 bonuses? You’ve come...

Mezzaninfinansiering kombinerer gjelds- og egenkapitalfinansiering, noe som gjør det til et attraktivt alternativ for...

If you’re looking to sell your mobile phone in the USA, there are plenty...

Getting ready to visit Portugal? There are so many travel websites that it can...

Understanding the rules and regulations of poker in the context of non-Gamstop casinos is...

Online casinos that aren’t run by or approved by the UK Gaming Commission are...

If you want to grow your business and reach new heights, you need to...

For good financial health, it’s important to understand credit numbers well. You can think...

Businessmen and CEOs should be ahead of the curve in the hectic environment of...

Regular exercise is crucial for maintaining good health and overall well-being. Physical inactivity has...

It’s important for our health and well-being to get enough sleep. Our bodies heal...

In today’s fast-paced world, stress is becoming more and more common. It’s more important...

To improve your financial position, you must avoid making common financial mistakes and falling...

As a business owner, you need to have certain skills for your company to...

Taking care of your own money is important for long-term safety and financial protection....

Businesses that want to get the most out of their marketing investments need to...

Do you want to know what’s going on with your favorite Hollywood stars? The...